SCUML APPLICATION GUIDE

One of the requirement for account opening for designated non financial institutions.

Section 25 of Money Laundering (Prohibition) Act defines Designated Non-Financial Institutions (DNFIs) as dealers in Jewelry, Cars and Luxury Goods, Precious Stones and Metals, Real Estate, Estate Developers, Estate Surveyors and Valuers, Estate Agents, Chartered Accountants, Audit Firms, Tax Consultants, Clearing and Settlement Companies, Hotels, Casinos, Supermarkets, Dealers in Mechanized Farming Equipment and Machineries, Practitioners of Mechanized Farming, Non-Governmental Organizations (NGOs) or such other businesses as the Federal Ministry of Trade and Investment or appropriate regulatory authorities may from time to time designate. Subsequently, money lending firms and few other businesses have been added to the category.

When your entity falls under any of the listed entities above, the banks request for SCUML certificate from the Economic and Financial Crimes Commission before a bank account is opened in the name of the entity.

The reason for this is to create an avenue to monitor the financial activities of those entities. After the registration, the entity is expected to file report of financial transactions to the commission. This financial transactions including money coming into the organisation or entity and those leaving the entity’s account. Lower transactions are not usually included.

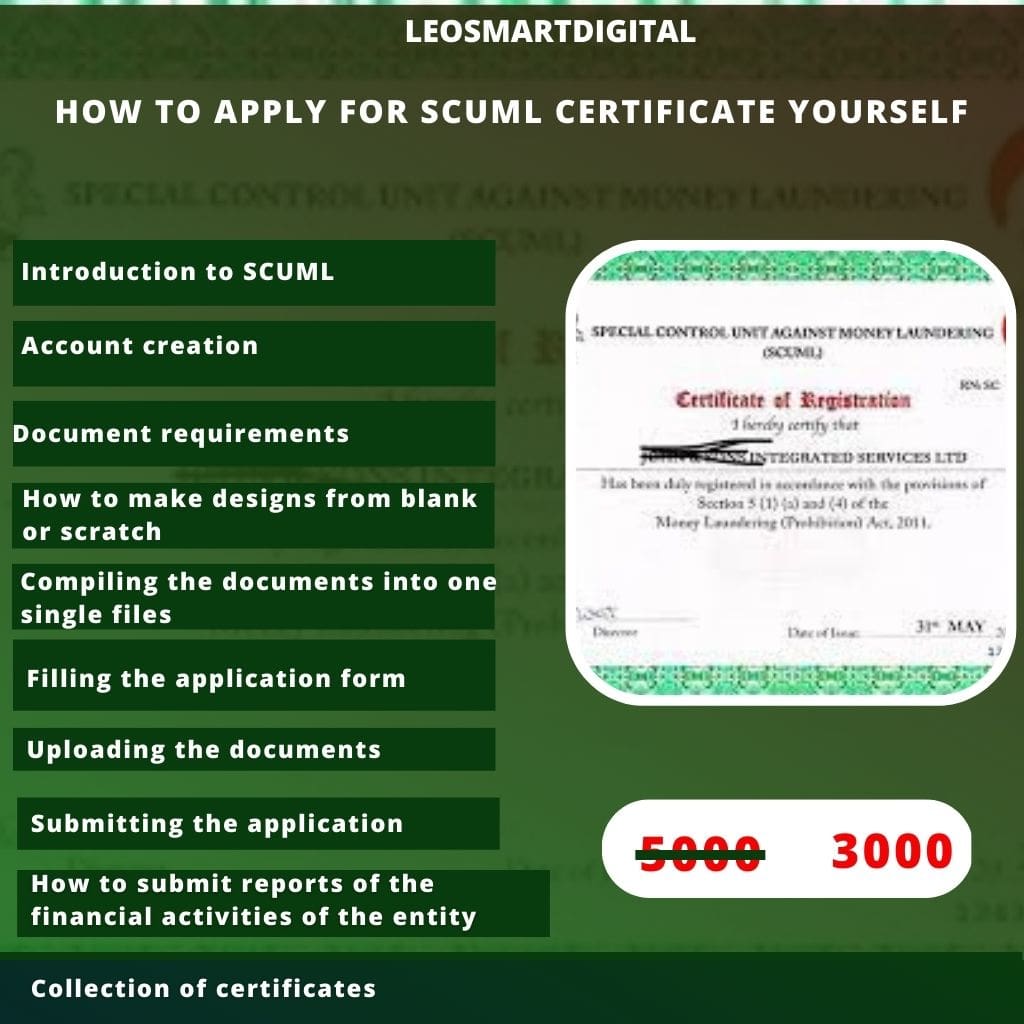

The course outlines include;

- Account creation

- Document requirements

- Compiling the documents into one single files

- Filling the application form

- Uploading the documents

- Submitting the application

- How to submit reports of the financial activities of the entity

- Collection of certificates

The SCUML application course is straight to the point process. You see the real time process. Following this guide, you will be able to carry out the process yourself from start to finish

The course cost #3000 only

Click on purchase to get the course and gain instant access